Regulators argued insurers might face legal exposure for doing business with a gun group during an era of mass shootings − and the NRA had no business peddling insurance.

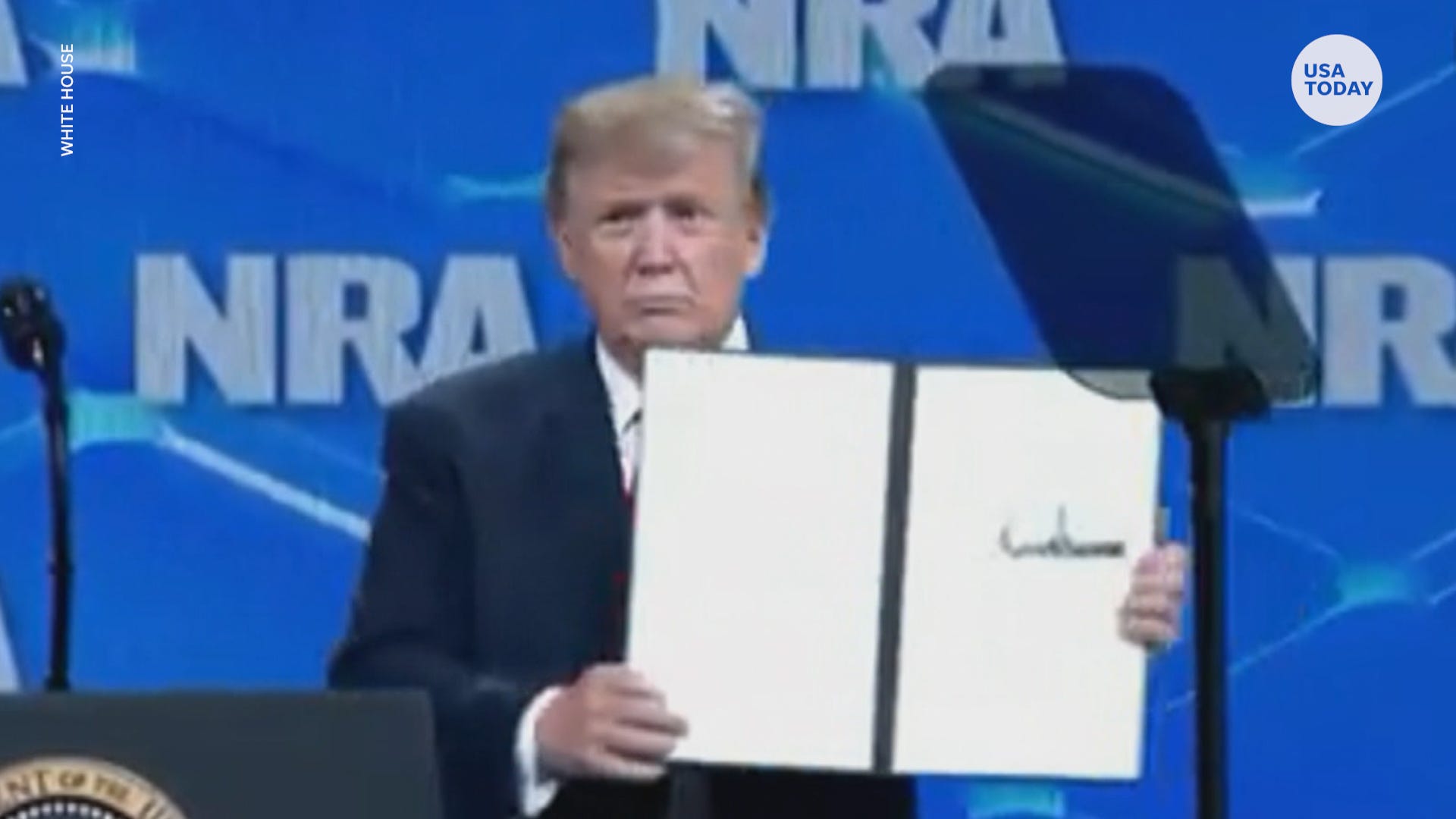

Trump to NRA crowd: We will never let anyone ‘trample’ on Second Amendment

At the NRA convention, President Trump announced his administration is withdrawing America’s signature from the U.N. Arms Trade Treaty. A global pact designed to regulate the sale of conventional weapons, from guns to battle tanks.

USA TODAY

WASHINGTON – The National Rifle Association will get another chance to punish New York regulators who discouraged insurers and bankers from doing business with the gun advocacy group, the Supreme Court ruled unanimously Thursday.

The NRA sued the New York Department of Financial Services, arguing regulators had coerced insurers against promoting policies by gun-rights group. But regulators, led by former Superintendent Maria Vullo, argued they were simply pointing out insurers might face legal exposure for doing business with a gun group during an era of mass shootings and major lawsuits − and the NRA had no business peddling insurance.

A U.S. District Court threw out most of the NRA’s case but allowed a First Amendment fight over whether Vullo was simply voicing an opinion, as allowed under the First Amendment, or coercing businesses she regulated, which is not allowed. The 2nd U.S. Circuit Court of Appeals found the claim of coercion not plausible and dismissed the case entirely.

But the Supreme Court on Thursday overturned the appeals court decision and allowed the NRA’s case to continue.

“Ultimately, the critical takeaway is that the First Amendment prohibits government officials from wielding their power selectively to punish or suppress speech, directly or, as alleged here, through private intermediaries,” Justice Sonia Sotomayor wrote in the decision.

How did New York regulate the NRA?

The NRA began marketing insurance policies in April 2017 called “Carry Guard” to cover legal expenses from using a firearm in self-defense. “Carry Guard” policies were administered by insurance broker Lockton and underwritten by insurers Chubb and Lloyd’s of London.

But the NRA wasn’t licensed to peddle insurance in New York and the Department of Financial Services began investigating in October 2017. Chubb and Lockton suspended the Carry Guard program the next month.

By February 2018, after a horrific school shooting in Parkland, Florida, Vullo began meeting with insurance executives who did business with NRA. What was said is disputed, but Lloyd’s of London decided to stop underwriting firearm-related policies that month.

“In short, she made it no secret that her purpose was to penalize an advocacy group because she opposed its political views,” the NRA argued.

The NRA sued Vullo, claiming she “abused her regulatory muscle to punish the organization for its First Amendment–protected speech and to suppress its future speech.”

In May 2018, two of the insurance companies admitted to unlawfully providing insurance in New York and agreed to pay $7 million from Lockton and $1.3 million from Chubb. In December 2018, Lloyd’s acknowledged violating state law and agreed to pay a $5 million fine.

The NRA agreed to pay $2.5 million and to refrain from offering insurance in New York for five years.

“Carry Guard violated New York law in numerous respects,” Vullo’s brief said. “It provided coverage for intentional acts and criminal defense costs.”

What is the NRA’s lawsuit about?

The NRA argued regulators went too far in discouraging insurers from doing business with the group.

On April 19, 2018, Vullo sent “guidance letters” to New York banks and insurers “in the wake of several recent horrific shootings,” listing Columbine High School, Sandy Hook Elementary School and a Las Vegas music festival. Vullo said the “social backlash” against the NRA and other gun-rights groups “is demanding change now.”

“The Department encourages regulated institutions to review any relationships they have with the NRA or similar gun promotion organizations, and to take prompt actions to managing these risks and promote public health and safety,” the letter said. Solicitor General Elizabeth Prelogar, speaking for the Biden administration, said the first four paragraphs of the New York letter were fair comment under the First Amendment, simply meant to convince companies not to do business with the NRA rather than coerce them.

But she acknowledged the final paragraph might have gone too far in targeting the NRA because of its viewpoint by encouraging businesses to consider “reputational risks” from dealing with “the NRA or similar gun promotion organizations.” Companies that fail to consider “reputational risks” to their businesses face the threat of multimillion-dollar fines from regulators.

Because of disputes over what Vullo told Lloyd’s at the time, Prelogar said courts would have to gather more evidence before deciding whether she went too far with them.

“The government has wide latitude to speak for itself, including by forcefully criticizing viewpoints with which it disagrees and encouraging citizens to disassociate from groups expressing those viewpoints,” Prelogar wrote in her filing. “But the government may not punish or suppress such viewpoints; nor may it coerce others into inflicting the punishment or suppression for it.”